Reaffirms double-digit full-year 2023 EBITDa Growth

Despite lower-than-expected q1 performance

American Vanguard Corporation (NYSE: AVD) today announced financial results for the quarter ended March 31, 2023.

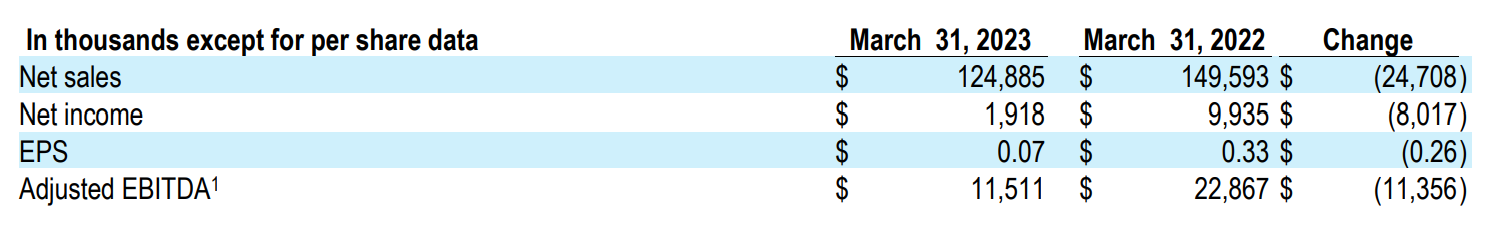

Q1 2023 Financial Performance – versus Q1 2022 (see table below):

Eric Wintemute, Chairman and CEO of American Vanguard, stated: “During 2023, we expect to achieve higher adjusted EBITDA (between $84MM - $86MM) than in 2022, despite a first quarter setback arising from delays in restarting our supply chain, which is now back at capacity. After experiencing multiple delays, our China-based supplier was unable to deliver intermediates in sufficient quantities for our leading corn soil insecticide, Aztec®, until early 2023. As a result, we were only able to produce and sell about one-third of seasonal demand for that product. This, coupled with a glut of generic herbicides (not sold by the Company) in the distribution channel, led to lower sales of domestic crop products during the quarter. While our domestic non-crop and international businesses recorded higher sales, the decrease in sales of higher-margin US crop products led to lower overall profitability.”

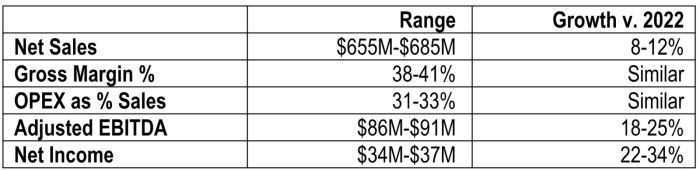

Mr. Wintemute continued, “Even after taking into account a lower-than-expected first quarter, we still expect full year 2023 will be stronger than 2022. With extremely low inventories of our domestic crop products in the distribution channel, we anticipate higher sales of US crop products in the second half of 2023. Further, we expect to continue the positive trajectories of our non-crop and international businesses. While below our original targets, our revised 2023 targets nevertheless show better year-over-year performance, as you can see from the table below.”

Mr. Wintemute continued, “For the sake of clarity, starting with this fiscal year, we have adopted an accounting change which is more prevalent among public companies in our sector under which outbound freight is classified as an element of cost of goods, as opposed to an operating expense. For us, these costs have typically been in the range of 7-8% of net sales. Thus, under this revised approach, our gross margin percent would decrease by that amount, and operating expenses as a percent of sales would decrease commensurately. This change has no effect upon operating income, adjusted EBITDA, net income or earnings per share.”

2023 Performance Targets

Mr. Wintemute concluded: “We look forward to giving you a more detailed presentation during our upcoming earnings call, including with respect to our 2025 growth targets.”

Note: Further details are available in the financial schedules attached to this press release.

View the recorded and archived webcast here.

_____________________________________________

[1] Earnings before interest, taxes, depreciation, amortization and non-cash stock compensation. Adjusted EBITDA is not a financial measure calculated and presented in accordance with U.S. generally accepted accounting principles (GAAP) and should not be considered as an alternative to net income (loss), operating income (loss) or any other financial measure so calculated and presented, nor as an alternative to cash flow from operating activities as a measure of liquidity. We provide these measures because we believe that they provide helpful comparisons to other companies in our industry and peer group. The items excluded from Adjusted EBITDA are detailed in the reconciliation attached to this news release, and reflect an elimination of taxes, interest, depreciation, amortization, the effects of equity compensation, and the proxy contest costs. Other companies (including the Company’s competitors) may define EBITDA differently.

ABOUT AMERICAN VANGUARD

American Vanguard Corporation is a diversified specialty and agricultural products company that develops, manufactures, and markets solutions for crop protection and nutrition, turf and ornamentals management, commercial and consumer pest control. Over the past 20 years, through product and business acquisitions, the Company has expanded its operations into 17 countries and now has over 1,000 product registrations in 56 nations worldwide. Its strategy rests on three growth initiatives – i) Core Business (through innovation of conventional products), ii) Green Solutions (with over 130 biorational products – including fertilizers, microbials, nutritionals and non-conventional products) and iii) Precision Agriculture innovation (including SIMPAS prescriptive application and Ultimus measure/record/verify technologies). American Vanguard is included on the Russell 2000® and Russell 3000® Indexes and the Standard & Poor’s Small Cap 600 Index. To learn more about American Vanguard, please reference the Company’s web site at www.american-vanguard.com.

The Company, from time to time, may discuss forward-looking information. Except for the historical information contained in this release, all forward-looking statements are estimates by the Company’s management and are subject to various risks and uncertainties that may cause results to differ from management’s current expectations. Such factors include weather conditions, changes in regulatory policy and other risks as detailed from time-to-time in the Company’s SEC reports and filings. All forward-looking statements, if any, in this release represent the Company’s judgment as of the date of this release.

CONTACTS

Company

American Vanguard Corporation

William A. Kuser, Director of Investor Relations

williamk@amvac.com

(949) 375-6931

Investor Representative

The Equity Group Inc.

www.theequitygroup.com

Lena Cati

lcati@equityny.com

(212) 836-9611