FY Net income increased 47% – STRONG OUTLOOK FOR 2023

American Vanguard Corporation (NYSE: AVD) today announced financial results for the full year ended December 31, 2022.

Fiscal Highlights Full Year Financial Highlights – versus Fiscal 2021 Full Year:

- Net sales were $610 million in 2022, compared to $558 million in 2021 (up 9%)

- Net income was $27.4 million in 2022, compared to $18.6 million in 2021 (up 47%)

- Earnings per diluted share of $0.92 in 2022, compared to $0.61 in 2021 (up 51%)

- Adjusted EBITDA[1] of $73.1 million in 2022, compared to $63.5 million in 2021 (up 15%)

Note: Further details are available in the financial schedules attached to this press release.

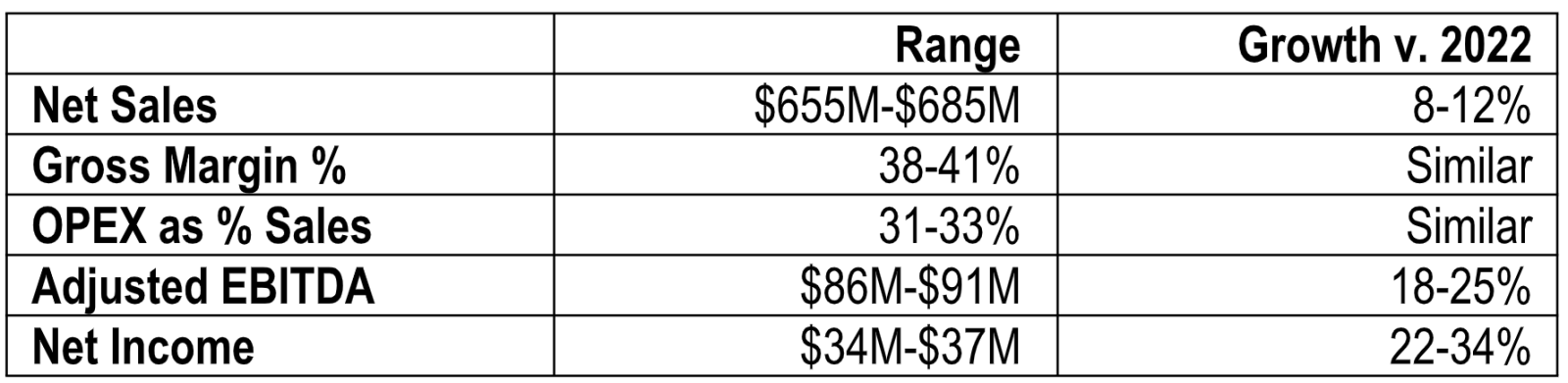

2023 Performance Targets

Eric Wintemute, Chairman and CEO of American Vanguard, stated: “Our full-year performance in 2022 exceeded that of 2021 in virtually every financial metric with net sales up 9% and net income up 47%. With high commodity prices and a strong farm economy, our U.S. Crop business recorded increased sales of our products in corn, soybeans, cotton, potatoes, and many fruits and vegetables. Our Non-Crop business experienced flat overall sales, in spite of a 30% drop in the domestic consumer product market. Further, our international business grew by 13% year-over-year, with increased sales of soil fumigants in Mexico and Australia, a milestone $100 million net sales record in Central America and expansion of our Green Solutions business into key markets. With demand for many of the high margin products that we produce in-house, we experienced greater efficiency within our manufacturing operations. At the same time, we strengthened our balance sheet through prudent allocation of capital, generation of cash and reduction of debt.”

Mr. Wintemute continued: “Looking forward, we are well positioned in both domestic and international markets for 2023, during which we are targeting increased net sales, and consistent gross profit and operating expense performance when compared to sales. During 2023, we are forecasting higher interest rates (due to the FOMC’s regular increases in the interest rate) and consequently higher expense. At the bottom line, we expect to see a solid increase in both net income, earnings per share, and adjusted EBITDA. During 2023, we will continue to develop our key strategic growth initiatives in innovative Core products, Green Solutions and SIMPAS/Ultimus technologies.”

Mr. Wintemute concluded: "During 2022 we have repurchased 1.7 million shares of the Company’s stock, representing approximately 5.5% of the outstanding shares. Furthermore, the board has authorized management to repurchase additional shares up to a total of $15 million dollars during 2023. Additionally, during 2022 we increased dividends per share by 31% reflecting our very strong financial performance. We look forward to giving you a more detailed presentation during our upcoming earnings call.”

[1] Adjusted earnings before interest, taxes, depreciation, amortization, non-cash stock compensation, and proxy contest activities. Adjusted EBITDA is not a financial measure calculated and presented in accordance with U.S. generally accepted accounting principles (GAAP) and should not be considered as an alternative to net income (loss), operating income (loss) or any other financial measure so calculated and presented, nor as an alternative to cash flow from operating activities as a measure of liquidity. The items excluded from Adjusted EBITDA are detailed in the reconciliation attached to this news release. Other companies (including the Company’s competitors) may define Adjusted EBITDA differently.

ABOUT AMERICAN VANGUARD

American Vanguard Corporation is a diversified specialty and agricultural products company that develops and markets products for crop protection and management, turf and ornamentals management, and commercial and consumer pest control. American Vanguard is included on the Russell 2000® and Russell 3000® Indexes and the Standard & Poor’s Small Cap 600 Index. To learn more about American Vanguard, please reference the Company’s web site at www.american-vanguard.com.

The Company, from time to time, may discuss forward-looking information. Except for the historical information contained in this release, all forward-looking statements are estimates by the Company’s management and are subject to various risks and uncertainties that may cause results to differ from management’s current expectations. Such factors include weather conditions, changes in regulatory policy and other risks as detailed from time-to-time in the Company’s SEC reports and filings. All forward-looking statements, if any, in this release represent the Company’s judgment as of the date of this release.

CONTACTS

Company

American Vanguard Corporation

William A. Kuser, Director of Investor Relations

williamk@amvac.com

(949) 375-6931

Investor Representative

The Equity Group Inc.

www.theequitygroup.com

Lena Cati

Lcati@equityny.com

(212) 836-9611